A Practical Guide to HS Codes for Dubai Customs & E-Invoicing Compliance

Discover hs codes dubai customs and learn how accurate classifications speed up UAE trade, FTAs, and customs clearance.

Posted by

Related Reading

A Practical Guide to E-Invoicing in the UAE

Master e invoicing in UAE. This guide breaks down the PINT AE standard, FTA compliance deadlines, and how to prepare your business for the 2026 mandate.

Read →

A Guide to TRN Verification FTA for UAE E-Invoicing

Master TRN verification FTA for UAE e-invoicing. Our guide covers manual checks, APIs, and batch validation to ensure VAT compliance and avoid penalties.

Read →

Your Guide to Seamless VAT Registration UAE Compliance

A practical guide to VAT registration UAE. Learn mandatory thresholds, required documents, and how to navigate the EmaraTax portal for full FTA compliance.

Read →

Navigating imports and exports in the UAE requires precision, especially when it comes to Harmonized System (HS) codes. Getting these codes right for Dubai Customs is not just a logistical step; it's a critical compliance task that directly impacts your duty payments, VAT calculations, and overall supply chain efficiency. A simple error can lead to costly delays, fines, and significant compliance headaches, especially with the upcoming shift to mandatory UAE e-invoicing.

This guide will walk you through the essentials of the Dubai Customs HS code system, common pitfalls to avoid, and how to align your processes for seamless FTA compliance.

Understanding the Shift to 12-Digit HS Codes

For years, UAE businesses operated with an 8-digit HS code standard. However, Dubai Customs has implemented a significant upgrade, expanding the system to a more detailed 12-digit format. This change isn't merely administrative; it's a strategic move to align with GCC unified trade regulations and enhance the accuracy of goods classification.

The primary benefit of the 12-digit system is granularity. It allows for a much more precise product breakdown, reducing the ambiguity that existed when multiple, distinct items fell under the same 8-digit code. This ensures that customs duties and taxes are calculated with pinpoint accuracy.

Breaking Down the 12-Digit Dubai Customs HS Code

To use the system effectively, it's helpful to understand its structure. Each segment of the code adds a layer of specificity, moving from a global standard to local requirements.

| Digits | Represents | Governing Body |

|---|---|---|

| First 6 Digits | The universal HS code | World Customs Organization (WCO) |

| Digits 7-8 | GCC Common External Tariff | Gulf Cooperation Council (GCC) |

| Digits 9-10 | National-level specifics | UAE Federal Government |

| Digits 11-12 | Local statistical or duty codes | Individual Emirates (e.g., Dubai Customs) |

This layered approach provides a clear and logical path to classifying goods, but it demands careful attention from your finance and logistics teams.

What This Means for Your Business Operations

The transition to a 12-digit HS code system directly impacts your financial processes and operational efficiency. A single incorrect digit can create a ripple effect of problems across your supply chain and financial reporting.

Here are the key implications for your business:

- Accurate Duty and VAT Calculations: The primary purpose of an HS code is to determine the correct customs duty. The precision of the 12-digit code minimizes the risk of overpaying or underpaying duties and ensures your VAT UAE calculations are correct from the start.

- Smoother Customs Clearance: Incorrect HS codes are a major red flag for customs authorities, often leading to shipment inspections and delays. Using the correct 12-digit code significantly increases the likelihood of a fast and smooth clearance process.

- Readiness for UAE E-Invoicing: The upcoming mandatory UAE e-invoicing system, based on the PINT AE standard, requires precise digital data. The HS code is a critical field in an e-invoice, and using the correct 12-digit format will be essential for FTA compliance.

This move by Dubai Customs reinforces the UAE's commitment to modernizing its trade infrastructure. Misclassifying an HS code can lead to customs holds and increase costs by 5-10% from duty recalculations alone. You can learn more about the official implementation in this report from PwC.

Mastering the 12-digit HS code is no longer just a logistics task. It is a core financial compliance responsibility that directly impacts your company's financial health and preparedness for the UAE's evolving digital tax landscape.

How to Accurately Classify Your Products

Correct product classification is the foundation of a smooth customs process. It prevents costly delays and ensures accurate duty calculations. The process involves a methodical approach, starting with a deep understanding of your product and leveraging official UAE customs tools to determine the correct code.

First, analyze the product's core technical specifications, not its marketing description. What is its primary function? What materials is it made of? For complex items, such as a multi-function electronic device, you must identify its principal function to classify it correctly.

Using Official UAE Tariff Tools

After profiling your product, turn to official resources. The tools provided by Dubai Customs and the UAE government are the definitive sources for hs codes dubai customs.

- Dubai Trade Portal: This is your primary resource. It features an integrated tariff search that allows you to find HS codes using product descriptions. It is an indispensable tool for any business importing goods into Dubai.

- UAE Integrated Tariff: The federal government maintains a comprehensive tariff schedule. Cross-referencing your findings here ensures your classification aligns with national standards.

- Al Munasiq AI Assistant: Dubai Customs provides an AI-powered tool, Al Munasiq, that can suggest classifications. While helpful for guidance, remember that the legal responsibility for the correct code rests with the importer or exporter.

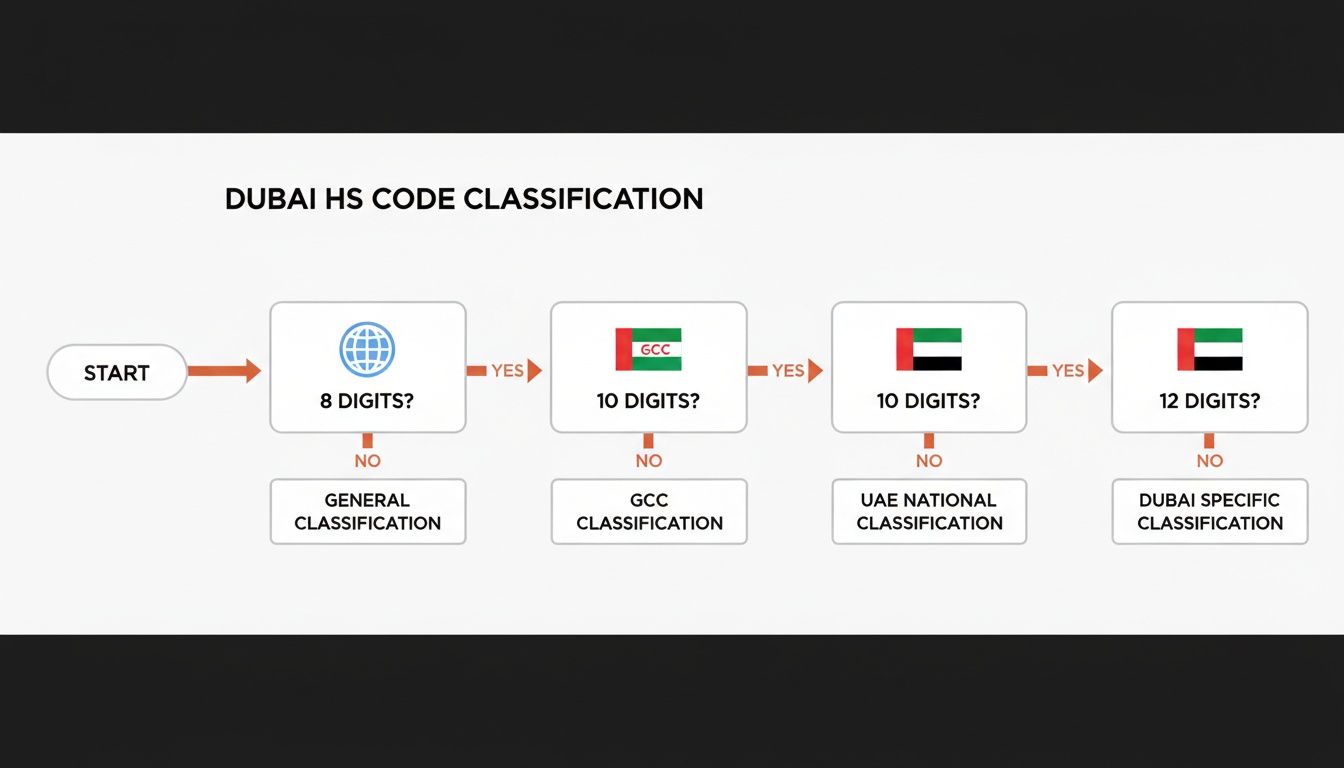

This flowchart illustrates the layered structure of HS codes in the UAE, from the global standard to local specifics.

As shown, the classification becomes more specific with each layer, starting with a global base and extending to a detailed 12-digit UAE code for certain goods.

Applying the General Rules of Interpretation (GRI)

What if a product seems to fit into multiple categories? This common challenge is addressed by the General Rules for the Interpretation of the Harmonized System (GRI). These official rules provide a step-by-step framework for accurate classification.

For a practical example, consider a gift set containing a leather wallet and a metal pen. According to GRI 3(b), composite goods should be classified based on the component that gives them their "essential character." If the wallet provides the primary value and function, the entire set would be classified under the HS code for the wallet, not the pen.

The Dubai Customs HS Code Inquiry service is an excellent tool for confirmation. It allows your finance team to verify codes directly with the authorities, providing documented evidence of your due diligence.

Mastering these steps establishes a reliable and repeatable process for your team. It is fundamental for achieving smooth customs clearance and correctly learning how to calculate VAT in UAE. This systematic approach supports broader FTA compliance and prepares your business for the detailed data requirements of UAE e-invoicing.

Common HS Code Mistakes and How to Avoid Them

While crucial, getting HS codes right can be challenging, and small errors can lead to significant problems like shipment delays, unexpected fines, and duty miscalculations that impact your profitability. Let's review the most common pitfalls so your business can avoid them.

One of the most frequent mistakes is classifying a product based on its marketing name rather than its technical function. A "smart wellness tracker," for example, must be classified based on its primary technical capability—be it heart rate monitoring, GPS tracking, or timekeeping. Customs officials rely on technical specifications, not marketing language.

Overlooking Product Kits and Modifications

Product kits are another common area for errors. When importing a grooming kit with an electric razor, cream, and a brush, you cannot classify each item separately. You must identify the item that provides the kit's "essential character"—in this case, the razor—and use its HS code for the entire set.

Similarly, product modifications can alter an item's classification. A minor change in a component or material could be enough to shift its HS code. It is essential to review codes whenever a product is updated, especially as the hs codes dubai customs system itself evolves.

The Critical Detail of Unit of Measure (UoM)

Perhaps the most common and easily avoidable error is a mismatch in the Unit of Measure (UoM). Many HS codes have a mandatory UoM, such as kilograms, pieces, liters, or square meters.

For example, a specific HS code for industrial textiles might require the quantity to be declared in square meters. If your internal systems and invoices track this product in kilograms, your customs declaration will be incorrect and likely rejected.

This level of detail is vital for FTA compliance and will become even more critical with the rollout of UAE e-invoicing. The PINT AE standard for an e-invoice is strict about data matching, and a UoM error can cause the entire invoice to be rejected. Ensuring data accuracy is key, and it helps to understand processes like FTA TRN Verification in the UAE.

To avoid these issues, establish a robust internal review process where finance and logistics teams collaborate. Cross-check codes against technical data sheets, not just supplier invoices, and conduct regular audits of your product master data to ensure every detail is accurate.

Navigating Customs Disputes and Rulings

Even with careful research, disagreements with Dubai Customs can occur. An officer may interpret your product's function differently, leading to a dispute over its HS code. When this happens, a clear and organized approach is essential to resolve the issue quickly and avoid unexpected costs.

The key to a successful appeal is strong evidence. You must build a comprehensive case to prove your classification is correct, leaving no room for ambiguity.

Building a Strong Case for an Appeal

When challenging a classification, your goal is to provide undeniable proof supporting your original code. This requires more than just a commercial invoice.

Here is the documentation that strengthens your case:

- Technical Datasheets and Specifications: These documents from the manufacturer detail the product's exact composition, primary function, and technical characteristics.

- Manufacturer's Declaration: A formal letter from the product manufacturer explaining its intended use can clarify its primary purpose.

- Product Samples or High-Resolution Photos: A physical sample allows customs officials to inspect the item, which can be highly persuasive.

- Explanatory Notes from the WCO: Citing specific text from the official World Customs Organization's explanatory notes demonstrates thorough research and reinforces your position.

Treat this process like an audit preparation. Well-organized and complete evidence increases your chances of a swift and favorable resolution. This level of documentation should be a standard part of your internal record-keeping.

A Proactive Strategy: Obtaining an Advance Ruling

A smarter approach is to prevent disputes before they happen by applying for an Advance Ruling. This is a formal, legally binding decision from Dubai Customs that classifies your goods before they are imported. It is particularly valuable for new, complex, or innovative products where classification may not be straightforward.

An Advance Ruling provides certainty by locking in the HS code and duty rate. This allows you to plan your finances accurately and eliminates the risk of unexpected costs or delays upon shipment arrival. It is an excellent tool for ensuring predictable landed costs and a smooth supply chain, especially when dealing with hs codes dubai customs.

Integrating HS Codes with E-Invoicing and ERP Systems

HS codes are no longer just a concern for logistics; they are now a critical data point for financial and tax compliance under the UAE's mandatory e-invoicing framework. The specific 12-digit HS code is a core field within the PINT AE standard, influencing how your invoices are structured and validated.

An incorrect HS code on an e-invoice is not just a minor typo—it can trigger a validation failure. This can cause the Federal Tax Authority (FTA) system to reject the entire invoice, disrupting your cash flow and compliance status.

Mapping HS Codes from Your ERP

The primary technical challenge is ensuring accurate data flows seamlessly from your Enterprise Resource Planning (ERP) system to the XML format required by the FTA. Whether you use Zoho, Wafeq, Oracle, or another system, your product master data must contain the correct 12-digit hs codes dubai customs.

This data must be mapped perfectly when an e-invoice is generated. Incorrect mapping will lead to a stream of rejections, delaying client payments and complicating VAT recovery. For more details on system requirements, refer to our guide on UAE e-invoicing.

Finance and accounting teams must recognize that customs and tax compliance are now intertwined. An accurate HS code is essential for validating data points like currencies, units, and dates in the FTA's XML files. Correcting this can prevent 20-30% of common invoice rejections caused by invalid codes or data mismatches.

Why Pre-Validation is Key to Avoiding Rejections

Discovering an error only after submitting an invoice is inefficient and costly. Pre-validation services offer a crucial safety check, catching problems between your ERP export and final submission.

These tools are designed to identify mismatches before they lead to rejections. For instance, if your ERP exports an invoice for textiles measured in kilograms, but the associated HS code requires square meters, a pre-validation platform will flag this error instantly. It translates complex validation rules into clear, actionable feedback for your team.

This proactive approach is invaluable for accounting firms and finance teams. Platforms like Tadqiq can scan ERP exports, identify issues like incorrect units tied to HS codes, and help you generate a compliant XML file every time. This aligns with Dubai's goal of 100% digital customs, which aims to reduce manual interventions by up to 50%, as detailed in this Portmind analysis.

Integrating HS code management into your invoicing workflow is essential for building a robust, accurate, and efficient financial operation that is prepared for the new era of digital invoicing.

Your Path to Seamless Compliance

Mastering the 12-digit HS code system is now a fundamental aspect of financial and tax compliance in the UAE. We've covered why correct hs codes for Dubai customs are essential, how to use official tools for accurate classification, and the importance of robust internal processes to avoid common errors.

The most critical takeaway is the direct link between HS codes and the upcoming UAE e-invoicing mandate. The two are inseparable. Accurate HS code management is no longer optional; it is a prerequisite for successful FTA compliance.

By adopting a proactive approach now, you position your business for smoother customs clearance, accurate duty payments, and a seamless transition to the digital tax era. Understanding these details is even more crucial in the broader context of VAT in UAE.

To learn more about the overall tax landscape, our detailed guide on what is VAT in UAE is an excellent resource.

Ready to streamline your e-invoicing? Try Tadqiq today.

Your Top Questions About HS Codes in Dubai Answered

When dealing with HS codes Dubai Customs, finance and logistics teams often have recurring questions. Here are answers to some of the most common inquiries from business owners and managers in the UAE.

Is a 12-Digit Code Required for All Shipments Now?

Not necessarily for every single shipment, as the transition to the 12-digit HS code is being implemented in phases. The requirement often depends on the specific customs declaration and trade route. For example, goods moving between Dubai and other GCC countries were among the first to require the new format.

Our advice is to begin updating your product master data with 12-digit codes now. This proactive step prepares you for future requirements and ensures readiness for the PINT AE e-invoicing mandate.

What Are the Consequences of Using an Incorrect HS Code?

Using an incorrect HS code can cause significant problems. At best, your customs declaration will be rejected, leading to resubmission and frustrating delays.

In a worst-case scenario, it can result in incorrect duty or VAT UAE calculations, leading to financial penalties, goods being impounded, and an increased risk score with Dubai Customs. Repeated errors can lead to more frequent inspections of your future shipments.

A common mistake is a mismatch between the HS code and its required Unit of Measure (UoM). This seemingly small error is a leading cause of clearance rejections and will guarantee an e-invoice validation failure under the new FTA compliance rules.

Can I Use the HS Code Provided by My Supplier?

While a supplier's HS code can be a useful starting point, you should never rely on it without verification. As the importer of record, the legal responsibility for correct classification rests with your business.

A code that is valid in the country of origin may not be correct for Dubai Customs. Always verify the code using official UAE tariff tools and cross-reference it with your product's detailed specifications. This due diligence is vital, as this data links directly to your official tax records, like your TRN Number in the UAE, where accuracy is paramount.

Ready to streamline your e-invoicing and ensure FTA compliance? Let Tadqiq pre-validate your invoices to catch errors before they become problems. Try Tadqiq today.