Unlocking HS Code Dubai: Your Guide to Accurate Classification & Compliance

Master hs code dubai with practical steps for accurate classification, customs compliance, and UAE e-invoicing readiness.

Posted by

Related Reading

A Practical Guide to HS Code Dubai Customs

Master the hs code dubai customs 12-digit system. Our guide helps UAE finance managers avoid costly errors and ensure seamless import compliance.

Read →

Your Guide to the HS Code UAE System for Tax and Customs

Master the HS Code UAE system. Learn to find and use the correct 12-digit codes for customs, VAT, and FTA e-invoicing compliance.

Read →

Debit Note and Credit Note: A Practical Guide for UAE E-Invoicing

Master the debit note and credit note for UAE VAT and e-invoicing. Learn their purpose, format, and how to ensure FTA compliance with PINT AE standards.

Read →

If you're a finance manager or accountant in Dubai, you can't afford to see Harmonized System (HS) codes as just another customs checkbox. These codes are the universal language for identifying products, and they dictate everything from import duties to your VAT calculations. They are a core pillar of financial compliance.

Get the classification wrong, even slightly, and you could be looking at costly penalties, incorrect tax payments, and serious disruptions to your operations.

Why HS Codes Are Critical for Your Dubai Business

Think of an HS code as a universal passport for your products. It's a multi-digit number used by customs authorities across the globe to make sure every single item is classified correctly. Here in the UAE, this system is woven directly into the country's financial fabric, and it hits your bottom line in a few critical ways.

Customs Duties and Tariffs

First and foremost, getting the HS code in Dubai right is how you determine the correct customs duty. A simple mistake can mean you overpay, chipping away at your profit margins. Worse, you could underpay, which often leads to hefty fines and a lot of unwanted attention from Dubai Customs.

VAT Compliance

The impact doesn't stop at the border. HS codes are directly linked to Value Added Tax (VAT). The Federal Tax Authority (FTA) uses these classifications to confirm that the right amount of VAT has been charged on imported goods. For a deeper dive into this, check out our detailed guide on what VAT is in the UAE.

The Foundation for E-Invoicing

Looking ahead, the importance of HS codes is only growing. They are set to become a foundational element of the UAE's upcoming mandatory e-invoicing system, making accuracy more critical than ever.

Inaccurate HS codes can trigger a domino effect of compliance problems. What starts as a simple mistake at the customs stage can ripple through your VAT returns and, very soon, your e-invoices. This creates a nightmare of reconciliation headaches for any finance team.

For any business trading goods in the UAE, mastering the HS code system is no longer a choice—it's a fundamental part of smart financial management and smooth operations.

Understanding the UAE HS Code System

To get a handle on your finances and stay compliant in Dubai, you first need to wrap your head around the HS code. It’s best to think of it as a highly detailed address for your product. It starts broad, like a country, and then drills down to a very specific location, ensuring every item gets classified with pinpoint accuracy.

The first six digits of any HS code are universal. They’re set by the World Customs Organisation (WCO), which means a product classified with these digits in Dubai is recognised the same way in over 200 other countries. This global standard is the bedrock of international trade.

But for businesses here in the UAE, the real story begins with the digits that come after.

The Role of Local Digits

It's the next set of digits, extending the code to 12 digits in the UAE, where local and GCC-specific rules kick in. These extra numbers add a layer of detail for Dubai Customs and the Federal Tax Authority (FTA), allowing them to distinguish between products that might otherwise look the same. They're what determine the exact duty rates, flag any exemptions, and help compile accurate trade statistics.

For anyone operating in Dubai, the HS code is now a critical link between customs clearance, VAT calculations, and even e-invoicing. The UAE’s Federal Authority for Identity, Citizenship, Customs & Port Security makes it clear: while the first six digits are globally harmonised, the remaining national digits dictate UAE-specific duty rates and controls. You can learn more about the UAE's tariff system from the official source.

Think about it—for an importer dealing with high-value goods, a 5% customs duty can make or break a profit margin. Picking the wrong 12-digit code could completely alter your landed costs and the 5% UAE VAT that gets calculated on top. And with Dubai and Abu Dhabi Customs mandating the full 12-digit structure from 1 August 2025, there’s a real urgency for businesses to get their ERPs and invoice templates updated.

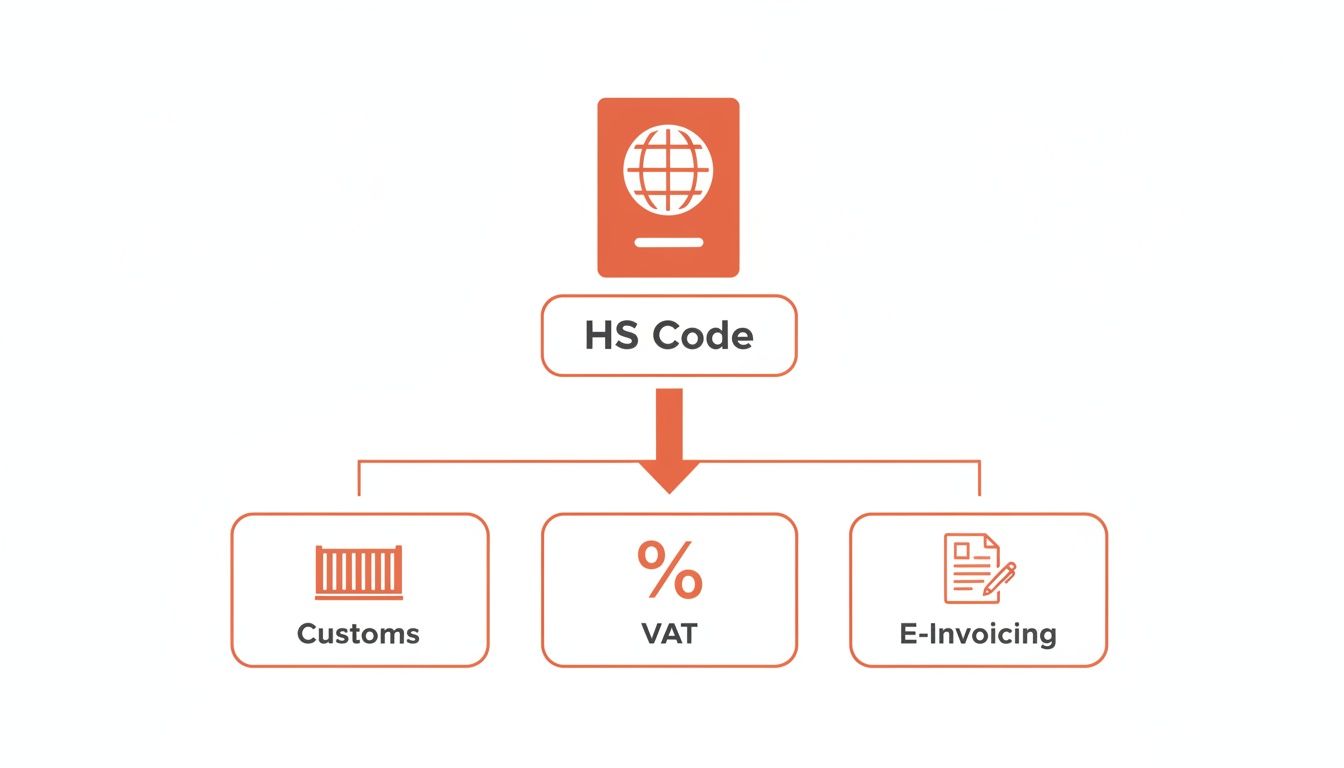

This diagram shows just how central the HS code has become, directly feeding into customs, VAT, and e-invoicing.

The message is clear: an HS code is no longer just a customs formality. It’s a vital piece of data that sets off a chain reaction of financial calculations and compliance checks across your entire operation.

Why This Matters for Your Bottom Line

Getting to grips with the detailed 12-digit HS code system isn't just an administrative task; it directly affects your company's profitability. A simple classification error can easily lead to:

- Duty Overpayment: Classifying a product under a code with a higher-than-necessary duty rate eats directly into your profit margin on every single shipment.

- Costly Penalties: On the flip side, underpaying duties because of a mistake can attract hefty fines from Dubai Customs when they conduct an audit.

- Inaccurate VAT Calculation: VAT is applied to the total value of goods plus customs duties. An incorrect duty calculation automatically leads to an incorrect VAT payment, putting you at risk with the FTA.

Ultimately, mastering the HS code structure isn't just about dodging penalties. It's about gaining tight control over your landed costs, maintaining accurate financial records, and future-proofing your business for the next wave of digital compliance, including the mandatory PINT AE e-invoicing standard.

Navigating the Shift to 12-Digit HS Codes

One of the biggest changes hitting Dubai businesses right now is the switch to a new 12-digit Integrated Customs Tariff. This isn't just a minor tweak to the paperwork; it’s a fundamental change that your finance and accounting teams need to get on top of, and fast. The goal is to bring the UAE's system in line with broader GCC standards and capture far more accurate trade data.

Think of it this way: the number of potential classifications is ballooning from around 7,800 to over 13,400. That’s a massive 72% increase in detail. For your business, it means an 8-digit code you’ve used for years might now splinter into several different 12-digit codes, each with its own specific criteria. Getting it wrong is not an option.

Understanding the Phased Rollout

The good news is that Dubai Customs is rolling this out in stages, giving everyone a chance to adapt. Instead of a sudden, chaotic switch, the implementation is staggered based on where your goods are coming from and going to.

Here’s how the timeline breaks down:

- Phase 1 (From August 2025): The first wave focuses on trade between Dubai and other GCC nations. All statistical import and export declarations within the GCC will need the new 12-digit codes.

- Phase 2 (From February 2026): Next, the rules will apply to goods moving from Free Zones and Customs Warehouses into the mainland.

- Phase 3 (From August 2026): This is the big one. All remaining mainland imports from outside the GCC will come under the new system.

- Phase 4 (From February 2027): Finally, the changes will cover temporary movements, like re-exports and temporary admissions.

This staggered approach means your team will likely be juggling both 8-digit and 12-digit codes for a while, depending on the shipment. It’s crucial to know which rules apply to which transaction.

Practical Steps for Your Finance Team

The only way through this is to be proactive. Between 2024 and 2025, importers have already started adjusting to this new world. Based on Dubai Customs Notice No. 10/2025, a critical six-month grace period begins on 1 August 2025, allowing for both code systems to be used for GCC-bound declarations. This overlap is a golden opportunity for finance teams to get their systems aligned, especially with UAE e-invoicing on the horizon. Getting this right now will prevent expensive classification disputes and audit headaches later. You can get more expert analysis on this from PwC Middle East's take on the UAE tariff changes.

The move from an 8-digit to a 12-digit HS code system effectively doubles the complexity of product classification. It demands a meticulous review of your entire product database to ensure every single item is mapped correctly. This impacts everything from your landed cost calculations to your final VAT reporting.

To get your team ready, here are the essential steps:

- Audit Your Item Master: Go through every SKU in your ERP system and painstakingly map each one to its new 12-digit HS code Dubai equivalent.

- Update System Fields: Check that your accounting software, ERP, and invoicing platforms can actually handle the longer 12-digit codes. This might sound simple, but it can be a real technical hurdle.

- Train Your Staff: Get your finance, logistics, and procurement teams in a room and walk them through the new requirements and the rollout schedule. Everyone needs to be on the same page.

- Liaise with Partners: Talk to your customs brokers and freight forwarders. Make sure they are fully aligned with your updated classifications to avoid delays at the border.

Going through this process will also have a positive side effect: it will clean up your financial data, leading to more accurate cost allocation and VAT UAE calculations. If you need to brush up on the basics, our guide on how to calculate VAT in the UAE is a great place to start.

How to Classify Your Goods Correctly in Dubai

Figuring out the right HS code for your products in Dubai might seem intimidating at first, but it’s actually a very logical process. The best way to think about it is like a funnel. You start with a broad product category and gradually narrow it down until you land on a highly specific classification.

Getting this four-step method right is crucial. It’s the key to avoiding frustrating delays at customs and staying compliant with your VAT obligations. The entire system is built on a set of global standards known as the General Interpretative Rules (GIRs). The official text can be a bit heavy, but the main idea is simple: classify an item based on what it is, what it’s made of, and its main purpose.

A Four-Step Process for Accurate Classification

To find the correct HS code in Dubai, you need to be methodical. If you follow these steps, you can work your way through the official tariff schedule and confidently find the exact 12-digit code for your shipment.

-

Define Your Product's Core Identity: Before you even glance at a tariff schedule, get crystal clear on what your product is. What does it do? What are its primary materials? For instance, is a smartphone fundamentally a device for communication (its function) or a cluster of electronic parts (its material)? In most cases, the primary function is the deciding factor.

-

Find the Right Chapter and Heading: The HS Tariff is organised into Sections and Chapters. Your first move is to find the chapter that best matches your product's general category. For anything electronic, you'll likely start in Chapter 85. From there, you'll look for the four-digit heading that describes the product group—like 8517, which covers telephones, including smartphones.

-

Narrow It Down with Subheadings: Now it's time to get more specific using the six-digit subheadings. This is where you start accounting for particular features. Sticking with our smartphone example, the subheading 8517.13 is specifically for "Smartphones," setting them apart from other kinds of phones.

-

Lock in the Final 12-Digit UAE Code: The last step is to navigate the local UAE-specific subdivisions. This takes you from the international six-digit code to the full 12-digit code required by Dubai Customs for calculating duties and gathering trade statistics.

Using Official Dubai Customs Resources

Dubai Customs offers some incredibly helpful online tools to assist businesses in finding the right HS code information. These resources are your definitive source for classification in the emirate, so it pays to get familiar with them.

For example, you can look up information directly through the Dubai Customs eServices portal for HS Code inquiries.

This portal is your direct link to the official, up-to-date data. It's the best way to ensure your customs declarations are built on the most current and accurate classifications.

One of the most common pitfalls we see is businesses blindly using the HS code provided by their supplier. Classifications can differ from one country to another, and as the importer of record in the UAE, the legal responsibility for accuracy falls squarely on you. Always double-check using official Dubai Customs tools.

Let’s walk through a quick example to see how this works in practice. We'll use a common electronic device to illustrate the step-by-step logic from the general chapter down to the specific subheading.

HS Code Classification Example for an Electronic Device

The table below breaks down how specific product details guide you to the correct HS code digits.

| Product Attribute | Classification Logic | Corresponding HS Code Digits |

|---|---|---|

| Product Type | Electrical machinery and equipment | Chapter 85 |

| General Function | Telephony and communication devices | Heading 8517 |

| Specific Type | A cellular network telephone | Subheading 8517.1 |

| Key Feature | A 'Smartphone' with an operating system | Subheading 8517.13 |

| UAE Specifics | Further national subdivisions for duty/stats | Final 12 Digits (e.g., 8517.13.00.00.00) |

As you can see, each set of digits adds another layer of detail. This precision is absolutely vital. The final code not only determines the duty rate but is also essential for accurate VAT in the UAE reporting and will be critical for future compliance with UAE e-invoicing mandates. Getting it right from the start saves a lot of headaches later.

Common HS Code Mistakes and How to Avoid Them

Getting an HS code wrong, even by a little bit, can throw a massive wrench in the works for any business importing into Dubai. We’re not talking about small hiccups; a simple classification mistake can lead to your goods being held up at the border, surprise fines, and incorrect VAT payments. It’s the kind of error that ripples through your supply chain and messes with your financial forecasts.

So, what are the most common traps people fall into?

The biggest one, by far, is just blindly copying the HS code your overseas supplier gives you. Think of their code as a suggestion, not a fact. The supplier might be working off their country's rules, which don't necessarily match the specifics for the UAE or the wider GCC. At the end of the day, you're the importer, and the legal responsibility for getting it right lands squarely on your shoulders.

Another classic mistake is recycling old codes. You used a code for a shipment six months ago, so it must be fine for this one, right? Not necessarily. The tariff schedule is updated all the time, and what was correct then might be wrong now.

Overlooking Product Details

This is where the real nuance comes in. A product's primary function or what it's made of can completely change its classification.

Take a smartwatch, for instance. Is it an electronic device from Chapter 85, or is it a timepiece from Chapter 91? The answer depends entirely on its principal function. Making that call requires digging into the General Interpretative Rules, not just making a quick guess.

A single shipment of electronic components valued at AED 500,000, if misclassified at a 0% duty rate instead of the correct 5%, could result in an underpayment of AED 25,000 in customs duty alone. This error would also lead to an incorrect VAT declaration, potentially attracting penalties from both Dubai Customs and the FTA.

Inadequate Internal Processes

Honestly, most of these problems start at home. When there’s no solid internal process for checking, double-checking, and documenting HS codes, mistakes are almost guaranteed to happen. This is especially true if you’re managing a large and constantly changing product list.

To get ahead of these risks and maintain solid FTA compliance, you need to build a bit of a safety net. Here’s what I recommend:

- Establish a Verification Protocol: Before any new product is shipped, make it a mandatory rule to verify the HS code using official Dubai Customs resources. Never, ever take a supplier’s code as the final word.

- Conduct Regular Audits: Every so often, take a look at the codes for your best-selling items. Are they still correct? This is crucial, particularly with the shift to the 12-digit system. A little check-up can save you a big headache.

- Maintain Detailed Records: For every product, keep a simple log of how you decided on its HS code. Note the rules or tariff notes you used. If you ever face a customs audit, this documentation is your best friend. It’s just as vital as keeping track of your Tax Registration Number, which we cover in our guide on understanding your TRN in the UAE.

- Seek Expert Advice When Unsure: Don't guess. If you’re dealing with something complicated—like chemicals, machinery that does multiple things, or products sold as a kit—it's time to call in a professional. A customs broker or a trade compliance specialist can prevent an expensive mistake before it happens.

Putting these simple controls in place will dramatically lower your risk. It ensures your HS code Dubai practices are not only accurate but also completely defensible if customs ever comes knocking.

HS Codes and the New Wave of UAE E-Invoicing

HS codes are about to become a lot more important than just a customs formality. For finance managers and business owners in the UAE, these codes are the bedrock of the country's upcoming mandatory e-invoicing system. They’re no longer just a concern for your logistics team; they're a critical piece of your financial data puzzle.

Think of it this way: the HS code is graduating. It’s moving from a shipping document detail to a core component of every single electronic invoice. Getting it right is the key to ensuring your invoices sail through the new automated tax systems without a hitch.

A Single Source of Truth for Customs and Tax

Under the new PINT AE standard for UAE e-invoicing, every single line item on an invoice will need its corresponding HS code. It acts as a universal product language, giving crystal-clear details for every transaction, whether it's a local sale or an international shipment.

This system effectively bridges the gap between Dubai Customs and the Federal Tax Authority (FTA). It creates a direct, unbroken line of data from the port to your tax return. For this to work, the HS codes you use must be perfectly consistent across all your declarations. This isn't just a suggestion—it's essential for the FTA's automated systems to validate your transactions.

How to Avoid Automated Red Flags

Imagine your e-invoice says one thing, but your customs declaration says another. Even a small difference in the HS code in Dubai will immediately trigger a red flag in the new digital system. It tells the authorities that something doesn’t add up.

This isn’t a minor clerical error anymore. The consequences of these automated checks are real and can directly impact your cash flow and operations:

- Instant Invoice Rejection: The FTA’s system won't just question a mismatched invoice; it will likely reject it outright. The transaction simply stops.

- Frozen Payment Cycles: A rejected invoice means you don't get paid. The entire payment process is paused until you fix the error and resubmit everything correctly.

- Unwanted Scrutiny: A pattern of mismatches is a sure way to get your business flagged for a closer look, potentially leading to a time-consuming audit by the FTA.

The move to 12-digit HS codes has serious implications for both trade and compliance. Authorities like the Statistics Centre – Abu Dhabi rely on this data to track billions of dirhams in trade and monitor VAT collections. When the HS code on your e-invoice doesn't match your customs declaration, it creates a discrepancy in datasets used for risk profiling, raising automated alarms.

Mastering your HS codes now is the single best preparation for the shift to e-invoicing. It ensures your data is clean, compliant, and ready for this new chapter in UAE business. To get the full picture, dive into our complete guide on UAE e-invoicing.

Your Action Plan for HS Code Compliance

So, we've walked through the ins and outs of HS codes in Dubai, from how they affect customs duties to their future role in UAE e-invoicing. Now, let's put that knowledge to work. Getting a handle on your HS codes is more than just a box-ticking exercise for compliance; it's a vital part of keeping your company financially healthy and operationally sharp.

Following a clear plan of action is the best way to sidestep risks, stay on the right side of FTA compliance, and get your business ready for what's next in the UAE's digital finance world.

Your Essential Checklist

To get your processes in order, concentrate on these key areas. Think of this checklist as your roadmap to managing HS code Dubai responsibilities with real confidence.

-

Audit Your Product Database: It’s time for a deep dive. Go through every single product in your ERP or item master list. Your job is to map each one to the correct 12-digit HS code using the official Dubai Customs tariff schedule—don't just take your supplier's word for it.

-

Establish a Verification Process: Set up a non-negotiable checkpoint for all new products. Before that first shipment even thinks about landing, someone on your team needs to be responsible for verifying and documenting its HS code classification.

-

Train Your Teams: Get everyone on the same page. Your finance, procurement, and logistics staff all need to grasp why HS codes matter, what the shift to 12 digits means for them, and how they play a part in keeping everything accurate. Good training is your best defence against expensive mistakes.

-

Update Your Systems: This one is crucial. Check that your invoicing and accounting software can actually support 12-digit HS codes. It's a key technical step to get right, especially with the PINT AE standard on the horizon. For more on getting your data ducks in a row, check out our guide on FTA TRN verification.

By taking these steps, you're not just reacting—you're building a solid framework. This system will support accurate customs declarations, precise VAT UAE reporting, and a much smoother move into mandatory e-invoicing when the time comes.

Ready to streamline your e-invoicing? Try Tadqiq today.