UAE VAT Returns: A Practical Guide to Flawless Filing

Master a simple, compliant approach to vat returns uae and stay compliant with UAE VAT rules, with practical tips to avoid errors and penalties.

Posted by

Related Reading

A Practical Guide to E-Invoicing in the UAE

Master e invoicing in UAE. This guide breaks down the PINT AE standard, FTA compliance deadlines, and how to prepare your business for the 2026 mandate.

Read →

A Practical Guide to HS Codes for Dubai Customs & E-Invoicing Compliance

Discover hs codes dubai customs and learn how accurate classifications speed up UAE trade, FTAs, and customs clearance.

Read →

A Guide to TRN Verification FTA for UAE E-Invoicing

Master TRN verification FTA for UAE e-invoicing. Our guide covers manual checks, APIs, and batch validation to ensure VAT compliance and avoid penalties.

Read →

Filing your VAT returns in the UAE is a critical financial responsibility for any business registered with the Federal Tax Authority (FTA). It is your official report detailing all sales, purchases, and the VAT you've managed. Getting this process right is fundamental to staying compliant and avoiding significant financial penalties.

Understanding Your Core VAT Return Obligations in the UAE

First, let's clarify what the Federal Tax Authority (FTA) expects from you. VAT is a cornerstone of the UAE's financial system, and the FTA takes accurate, timely reporting very seriously.

If your business is registered for VAT, you must file a return. The frequency depends on your turnover and the tax period assigned by the FTA.

- Quarterly Returns: This is the standard schedule for most businesses.

- Monthly Returns: Larger businesses, typically with an annual turnover exceeding AED 150 million, are often required to file monthly.

Regardless of your schedule, the deadline is firm: the 28th day of the month following the end of your tax period. Missing this date results in immediate penalties.

What Information is Required for Each Return?

Your VAT return (known as the VAT 201 form) is a summary of your taxable activities. To complete it accurately, you need precise figures for several key areas.

This includes your total sales and the output VAT collected across every Emirate you operate in. You also need a clear record of your total purchases and the recoverable input VAT paid to suppliers. The final calculation is straightforward: Output VAT minus Input VAT. The result determines whether you owe a payment to the FTA or are eligible for a refund. For a deeper look, our guide on what is VAT in the UAE covers these concepts in more detail.

How E-Invoicing Will Transform VAT Filing

The upcoming mandate for UAE e-invoicing will fundamentally connect your invoicing process to your VAT filing. Soon, e-invoices issued under the PINT AE standard will become the official, verifiable source of data for your VAT return.

For accounting firms and finance managers, this means the end of tedious manual data entry and post-filing reconciliations. Standardising your data collection now is critical. You must prepare for a system where your VAT return is essentially pre-populated using validated e-invoice data, demanding a higher level of accuracy from the very start.

Preparing and Reconciling Data for Your VAT Return

An accurate VAT return is the result of diligent and consistent work throughout the entire tax period. Submitting a clean return to the Federal Tax Authority (FTA) begins with organising your financial data, regardless of your accounting system. This foundational work is what prevents costly errors and last-minute stress.

The process centers on two key figures: the output VAT you've collected on sales and the input VAT you've paid on business purchases. You must compile every sales invoice to determine what you owe the FTA, and gather all purchase invoices to calculate the recoverable input tax you can claim. An error on either side will lead to an incorrect VAT liability.

Correctly Categorising Your Supplies

A common mistake business owners and accountants make is misclassifying supplies. Not every transaction is subject to the standard 5% VAT UAE rate, and errors here can invalidate your entire return. Your records must clearly distinguish between different types of supplies.

- Standard-Rated Supplies: These are most goods and services sold in the UAE, where you charge 5% VAT.

- Zero-Rated Supplies: These are taxable at a 0% rate. Examples include international transport or certain healthcare and education services. They must be reported, but no VAT is collected.

- Exempt Supplies: These fall completely outside the scope of VAT, such as certain financial services. You cannot recover input VAT on expenses related to making exempt supplies.

Failing to separate these categories properly can lead to overpaying the FTA or under-claiming the input tax you're entitled to. Both outcomes negatively impact your cash flow. If you need a refresher, our guide on how to calculate VAT in the UAE is an excellent resource.

The Critical Role of Reconciliation

After gathering and categorising your data, reconciliation is a non-negotiable step. This is where you verify your VAT records against your other financial statements to ensure everything aligns. Think of it as the final quality control check before submitting your numbers to the FTA.

The primary task is to match the figures in your VAT reports with your general ledger and bank statements. This simple check is highly effective at catching issues like missing invoices, duplicate entries, or transactions posted in the wrong tax period.

For example, if your general ledger shows total sales of AED 525,000 for the quarter, the total value of sales in your VAT records should also be AED 525,000 (including VAT). If the numbers don't match, you know there's a problem to fix before you file. It's far better to catch it now than to explain the discrepancy to an FTA auditor later.

Pre-Validation and PINT AE Compliance

With the UAE e-invoicing mandate approaching, another layer of preparation is becoming essential. Your invoice data must not only be financially accurate but also technically compliant with the PINT AE standard. Data that fails these technical checks will be rejected by your Accredited Service Provider (ASP), disrupting your entire filing process.

This is where pre-validation tools become invaluable. Instead of waiting for your ASP to find errors, you can check your invoice data against the official PINT AE business rules before submission. A platform like Tadqiq can scan a data export from your accounting system and instantly flag issues—such as an improperly formatted Tax Registration Number (TRN) or a missing mandatory field. This allows your team to fix errors at the source, ensuring the file you send is clean and compliant. This proactive step ensures your VAT returns UAE filing is a smooth, efficient process.

How to Get Your VAT Refund in the UAE

Filing your VAT return correctly is one thing; reclaiming your money when you're in a credit position is another. For many businesses, particularly those in export or B2B services, having a VAT credit is normal. However, that credit is not useful until it is converted to cash. Navigating the FTA's refund process effectively is crucial for maintaining healthy cash flow.

The Federal Tax Authority (FTA) has a defined process, but they are thorough. They will not issue a refund without careful review. Furthermore, recent changes to the VAT law have introduced a strict deadline, so you can no longer let old credits sit on your balance sheet indefinitely.

The VAT Refund Process Explained

When your VAT return shows a credit, you can either carry it forward to offset a future VAT liability or apply for a cash refund. If you are consistently in a credit position or have a large one-off amount, requesting a cash refund is almost always the best choice for your liquidity.

The process begins on the FTA's e-services portal after you file the return that generated the credit. However, submitting the application is just the start. Be prepared for a review from the FTA, which nearly always includes a request for additional documentation.

They will typically ask for:

- A sample of your sales invoices for the period.

- The top five to ten purchase invoices representing the bulk of your input tax claim.

- Bank statements to prove payment for those expenses.

- Customs declarations if you are claiming VAT on imported goods.

A clean, organised, and complete submission is vital. Most refund delays or rejections are due to disorganised paperwork or missing documents. Getting it right the first time will significantly speed up the process.

The Five-Year Deadline for Unclaimed Credits

A critical update every finance professional in the UAE must know is the introduction of a strict five-year time limit on recovering VAT. This fundamentally changes how you must manage historical VAT credits.

Effective January 1, 2026, this five-year limitation period will apply to all VAT refund requests and the use of credit balances. This means a VAT credit from Q1 2021 will expire and be lost forever after Q1 2026. To understand the full implications, you can learn more about the new UAE VAT rules.

That unclaimed VAT on your books now has an expiry date. The clock is ticking.

A Practical Workflow for Reclaiming Historical Credits

For finance teams, this new deadline creates an urgent recovery project. Leaving accumulated credits unclaimed is no longer a passive choice; it's a direct loss to your bottom line.

Consider a Dubai-based trading company that, due to its large volume of zero-rated exports, consistently has a VAT credit. Under the new rules, the credit from their Q2 2021 return will be permanently lost after Q2 2026 if they do not act.

Here is a straightforward workflow to claim these amounts before they expire:

- Review Your History: Pull all past VAT returns, going back to 2018. Identify every period where you had a net credit that was carried forward.

- Assess the Risk: Create a schedule listing each credit by tax period and its five-year expiration date. This will help you prioritise your claims.

- Organise Your Documents: For each significant credit, gather the necessary paperwork, including original purchase invoices and proof of payment. Ensure everything is 100% compliant with FTA standards.

- File Systematically: Avoid submitting one massive refund application, as this may trigger a lengthy audit. Instead, apply for the oldest periods first and work your way forward.

This is no longer just about compliance; it's a financial recovery mission to bring your overpaid cash back into the business.

Navigating the FTA Submission Process

After preparing and reconciling your data, the final step is submitting your VAT return to the Federal Tax Authority (FTA). This stage is filled with potential technical challenges, especially as the UAE transitions to a fully digital tax system. Understanding your submission options is key to ensuring your filing is accepted on the first attempt.

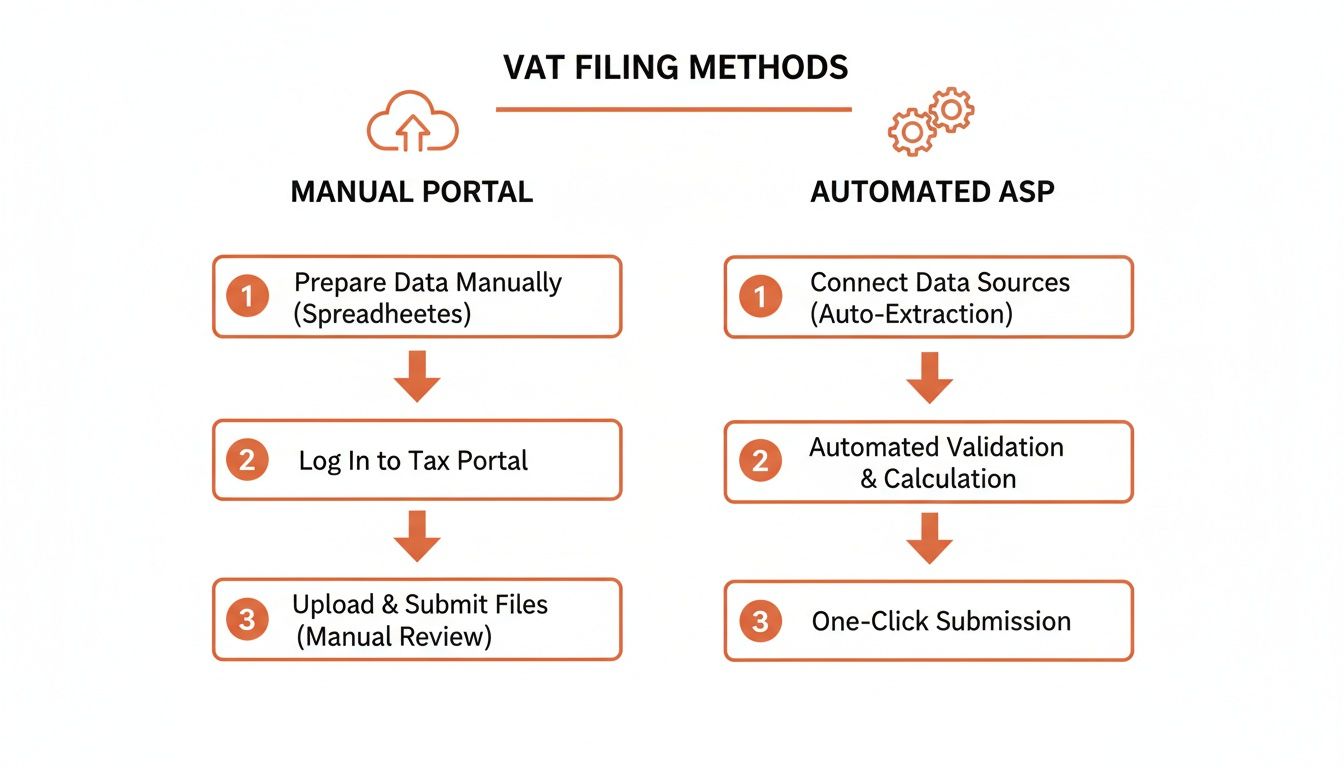

The traditional method has been direct filing through the FTA's online portal. However, the UAE e-invoicing mandate introduces a new channel via Accredited Service Providers (ASPs). Each path has its own workflow, and the best choice depends on your company's size and technical capabilities.

Direct Filing via the FTA Portal

The most common method for filing VAT returns UAE is through the FTA’s e-Services portal. This is a manual process where you enter your summarised figures directly into the VAT 201 form.

The VAT 201 form summarises your VAT activity for the period, with specific boxes for different figures from your reconciled accounts.

- Box 1 (VAT on Sales): For output VAT from standard-rated supplies in each Emirate.

- Box 3 (VAT on Sales Subject to Reverse Charge): For output VAT on imported services or goods.

- Box 6 (Goods Imported into the UAE): The value of all goods brought into the UAE.

- Box 9 (VAT Reclaimed on Expenses): The total input VAT you are claiming back.

- Box 14 (Total VAT Due): This is automatically calculated by the portal.

While straightforward for businesses with simple transactions, this method is prone to human error. A single misplaced digit can invalidate your declaration and lead to penalties.

ASP Submissions and the PINT AE Standard

The future of VAT filing is automated submission through an Accredited Service Provider. Under the new e-invoicing framework, businesses will send invoice data to an ASP, which then forwards it to the FTA. This system is built on the PINT AE standard, a strict set of technical rules for the format and content of every e-invoice.

Your invoice data must pass a series of automated validation rules before an ASP will accept it. If your data fails even one check, the submission is rejected instantly. This is a significant change from the manual portal, which primarily reviews your final summary figures. This new reality demands much higher data quality from the outset.

Troubleshooting Common Validation Errors

The move to PINT AE introduces a new challenge: validation errors. These are technical flaws in your data that prevent your file from being processed. Identifying and fixing them before submission is key. Pre-validation tools like Tadqiq can check your data against PINT AE rules before it leaves your system.

This screenshot shows a common example: error code BR-AE-10. The system has flagged an invalid Tax Registration Number (TRN) because it does not follow the FTA's required 15-digit format.

When you encounter these errors, the solution is always to correct the source data in your accounting software. Here are some of the most frequent validation issues.

| Error Code (Example) | Plain English Meaning | How to Fix in Your Data |

|---|---|---|

| BR-AE-10 | Invalid TRN Format: The Tax Registration Number for the buyer or seller is incorrect. | Find the customer or supplier record and ensure the TRN is exactly 15 digits long, with no spaces or special characters. |

| BR-CL-04 | Incorrect Date Format: An invoice or credit note date is in the wrong format. | All dates must be in the YYYY-MM-DD format. You will need to adjust your system's export settings. |

| BR-S-01 | Missing Mandatory Field: A required piece of information (like a supplier address) is blank. | Review the invoice data and fill in the missing field. This often requires updating your customer or supplier master files. |

| BT-131 | Invalid Item Unit Code: The code for a unit of measure (e.g., "Kgs" instead of "KGM") is not recognised. | Use the official UN/CEFACT code list for units of measure. For example, use "PCE" for a piece and "LTR" for a litre. |

Fixing these requires correcting the source data. For more help, see our detailed guide on how to handle FTA TRN verification.

Using a pre-validation service allows you to catch all these issues before sending your files to your ASP. This proactive step ensures your VAT return is accepted on the first try.

Managing VAT Returns for Multiple Clients

For accounting firms and tax consultants, managing VAT returns for a portfolio of clients presents a significant operational challenge. Each client uses a different accounting system and has unique data quality issues. To handle this complexity, you need a scalable and efficient workflow that ensures accuracy and FTA compliance.

The solution is to move away from manual, client-by-client processes and adopt a centralised, technology-driven approach. A robust workflow allows you to import client data, validate it in batches, and track every return from a single dashboard. This saves time and positions your firm as a forward-thinking partner, especially with mandatory UAE e-invoicing on the horizon.

Creating a Scalable Onboarding and Validation Process

To build a scalable workflow, standardise how you receive and process data. Instead of integrating with dozens of different ERPs, create a universal pre-processing step. Ask clients for a simple data export—usually a CSV or Excel file—which you can then import into a specialised validation tool.

Think of this as your firm's quality control gate. A platform like Tadqiq can take these raw files and instantly check them against the official PINT AE business rules—the same checks used by ASPs. It can process data from different sources and flag everything from incorrect TRN formats to invalid currency codes.

- Batch Processing: Upload and process files for multiple clients simultaneously, allowing a small team to validate thousands of invoices in minutes.

- Centralised Dashboard: Gain a bird's-eye view of all client activity. See which clients have submitted data, which files have passed validation, and which still need corrections.

- No Complex Integrations: By using a pre-validation tool as an intermediary, you avoid the cost and complexity of direct integrations with each client's accounting software.

This workflow transforms your team from reactive problem-solvers into proactive compliance managers, catching issues long before they reach the ASP.

This flowchart compares the old manual approach to a smarter, automated workflow for filing VAT returns.

As shown, an automated workflow eliminates manual work, centralises validation, and provides a cleaner path to achieving FTA compliance.

Enhancing Client Communication and Trust

A streamlined internal process also improves client communication. When you identify a data error, you can provide precise, actionable feedback instead of a vague request. This level of detail builds trust and showcases your firm's expertise.

For instance, an accounting firm receives an invoice export from a client. A pre-validation tool immediately flags that 37 invoices have an invalid unit of measure code. Instead of simply returning the file, the firm can provide a clear report showing the exact rows with the specific error. This turns a compliance issue into a valuable teaching moment.

This is not just good practice; it's essential for client retention. Providing clear, documented proof of validation shows you are actively protecting their business from potential FTA penalties. As the UAE e-invoicing mandate approaches, this capability will be a key differentiator for accounting firms. To learn more about the mandate, read our guide on the specifics of UAE e-invoicing.

Frequently Asked Questions About UAE VAT Returns

When dealing with VAT returns in the UAE, certain questions frequently arise. Whether you're a finance manager or a business owner, these are some of the most common queries we see.

Can I File My Own VAT Return?

Yes, you can file your own VAT return through the FTA's e-Services portal. For a small business with simple transactions, this can be a cost-effective option if you have a solid understanding of UAE VAT law.

However, the process is highly detailed. It requires perfect record-keeping and a thorough knowledge of the VAT 201 form. If your business has any complexity—such as international trade or mixed supplies—doing it yourself is risky. In these cases, hiring a tax professional is an investment in ensuring accuracy and maintaining FTA compliance.

What Happens if I File My Return Late?

The FTA enforces deadlines strictly. If you miss the submission deadline—the 28th day of the month after your tax period ends—you will face immediate administrative penalties for both late filing and late payment.

These penalties are significant, starting at AED 1,000 for a first-time offence and increasing with each subsequent miss. Beyond the financial cost, consistent late filings can flag your business for a potential FTA audit.

Are There Special VAT Refund Schemes Available?

Yes, the UAE VAT law includes specific refund schemes for certain groups that may have paid VAT but are not registered for it. This is different from standard input tax recovery.

Key schemes apply to:

- Foreign Businesses: Companies from eligible countries can often claim back VAT paid while attending exhibitions or business meetings in the UAE.

- Tourists: The well-known scheme allowing visitors to get a refund on VAT paid for goods they take out of the country.

- UAE Nationals Building New Residences: A provision allowing citizens to reclaim VAT spent on constructing a new personal home.

- Diplomatic Missions: Accredited foreign government bodies can typically recover VAT on local operational costs.

Each scheme has its own strict rules and documentation requirements.

How Do I Correct an Error on a Previously Filed Return?

If you discover a mistake in a submitted return, the official method for correction is to file a Voluntary Disclosure with the FTA. This is the formal process for notifying the authorities of an error or omission.

Being proactive is key. If you report the error through a Voluntary Disclosure before the FTA discovers it, you are in a much better position to minimise penalties. You will need to explain what went wrong, the affected tax period, and the correct tax amount. For guidance on preventing these mistakes, refer to our guide on how to register for VAT in the UAE.

Ready to streamline your e-invoicing? Try Tadqiq today at tadqiq.ae.