What Is VAT in UAE Your Guide to Rates and Compliance

Struggling with 'what is VAT in UAE?' Our guide breaks down rates, registration, returns, and e-invoicing compliance for business owners and accountants.

Posted by

Related Reading

A Practical Guide to E-Invoicing in the UAE

Master e invoicing in UAE. This guide breaks down the PINT AE standard, FTA compliance deadlines, and how to prepare your business for the 2026 mandate.

Read →

A Practical Guide to HS Codes for Dubai Customs & E-Invoicing Compliance

Discover hs codes dubai customs and learn how accurate classifications speed up UAE trade, FTAs, and customs clearance.

Read →

A Guide to TRN Verification FTA for UAE E-Invoicing

Master TRN verification FTA for UAE e-invoicing. Our guide covers manual checks, APIs, and batch validation to ensure VAT compliance and avoid penalties.

Read →

If you're running a business in the UAE, getting to grips with Value Added Tax (VAT) isn't just a box-ticking exercise—it's crucial for your financial health and staying on the right side of the law. Your business simply acts as a collection agent for the government, and this guide will break down everything you need to know, from the absolute basics to the new e-invoicing rules on the horizon.

What is VAT in the UAE? A Practical Overview

Understanding the UAE's VAT system is a fundamental part of doing business here. Getting it wrong can lead to hefty penalties and seriously disrupt your cash flow, which is why a solid grasp of how it works is non-negotiable for any company.

VAT officially rolled out in the UAE on 1 January 2018, a significant move in the country's economic strategy. This was laid out in Federal Decree-Law No. 8 of 2017, which brought in the standard 5% rate as part of a wider GCC agreement to create new revenue streams.

At its core, the system requires your business to manage the flow of tax. It breaks down like this:

- You add 5% VAT to your sales invoices and collect it from your customers. This is your output tax.

- You pay 5% VAT on your own business purchases and expenses. This is your input tax.

- You then pay the difference between the output tax you've collected and the input tax you've paid over to the Federal Tax Authority (FTA).

Nailing this process is the first, most important step to keeping your VAT affairs in order. For more detailed articles on tax and compliance, the Tadqiq blog is a great resource to explore.

The Core Mechanics of How VAT Works in the UAE

At its heart, Value Added Tax is a consumption tax. Every time a product or service moves from one business to another—from the manufacturer to the wholesaler, then the retailer—a little bit of tax is added.

While businesses along the chain collect and remit this tax, it's the final customer who ultimately bears the cost. For the government, businesses act as the collection agents, ensuring the system runs smoothly.

The whole process hinges on one key concept: a taxable supply. According to the Federal Tax Authority (FTA), this is any supply of goods or services made for payment by a business in the UAE. Simply put, if you sell something in the course of your business, you're almost certainly making a taxable supply.

Different Supplies, Different VAT Rates

Not all sales are taxed the same way. In the UAE, supplies fall into three distinct buckets, and knowing which one your products or services belong to is critical for your cash flow and compliance.

To make this clear, here’s a quick breakdown of the different VAT rates you’ll encounter.

| VAT Rate Type | Rate | Description and Examples |

|---|---|---|

| Standard-Rated | 5% | This is the default rate for the vast majority of goods and services. Think professional services, electronics, restaurant meals, and commercial rent. |

| Zero-Rated | 0% | These supplies are still taxable, but the rate is 0%. Key examples include exports, international transport, and certain educational or healthcare services. |

| Exempt | N/A | These supplies are completely outside the scope of VAT. This category includes things like certain financial services, the sale of bare land, and local passenger transport. |

It’s crucial to understand the difference between zero-rated and exempt. With zero-rated supplies, you don't charge VAT to your customers, but you can still reclaim the VAT you paid on your business expenses related to making those supplies. For exempt supplies, you can't register for VAT or reclaim any input tax at all.

The Core Calculation: Input vs. Output Tax

Getting VAT right really comes down to one simple calculation: the difference between the VAT you collect and the VAT you pay. This is the single most important concept to master for accurate VAT returns.

Output Tax is the VAT you charge and collect on your sales. If you invoice a client AED 1,000 for a standard-rated service, you add 5% (AED 50). The total bill is AED 1,050, and that AED 50 is your output tax—money you're holding for the FTA.

Input Tax is the VAT you pay on your business-related purchases and expenses. When you buy a new laptop for your office for AED 5,000 plus 5% VAT (AED 250), that AED 250 is your input tax. This is the amount you can usually reclaim from the FTA.

The formula for your VAT return is straightforward: Total Output Tax Collected - Total Input Tax Paid = VAT Payable to (or Refundable from) the FTA.

Every business registered for VAT is given a unique Tax Registration Number (TRN). This number must appear on all your tax invoices. To fully grasp its significance, you can learn more about what a TRN number is and its role in compliance. Getting this right is a foundational step for compliant accounting.

VAT Registration and Your Tax Registration Number (TRN)

Let's move from the 'what' of VAT to the 'how'. The first real step for any business is getting registered with the Federal Tax Authority (FTA). This isn't just admin; it's your formal entry into the country's tax system and sets the stage for everything that follows.

The All-Important Registration Thresholds

So, who needs to register? The FTA has made this clear with specific revenue thresholds based on the total value of your taxable supplies.

Here’s the breakdown:

- Mandatory Registration: If your turnover from taxable supplies tops AED 375,000 in a 12-month period, registration isn't a choice—it's a legal requirement.

- Voluntary Registration: If your turnover falls between AED 187,500 and AED 375,000, you don't have to register, but you can choose to.

Why would you register voluntarily? It can be a smart move. Registering allows you to claim back the VAT you pay on your business expenses (input tax), which can be a massive boost to cash flow for businesses with high start-up costs.

The Registration Process and Deadlines

Once your annual taxable turnover hits the AED 375,000 mark, you have 30 days to get registered on the FTA’s e-Services portal.

Miss that deadline, and you're looking at a steep AED 10,000 penalty. The FTA doesn't mess around here, so keeping a close eye on your turnover is non-negotiable. The process itself is handled entirely online; you’ll need documents like your trade licence, owner's passport copies, and proof of turnover.

What is a Tax Registration Number (TRN)?

Once your application is approved, the FTA will issue your business a unique Tax Registration Number (TRN). Think of this as your company’s tax passport—a 15-digit number that identifies you in every single interaction with the tax system.

You must display this number on all your key business documents, including:

- Every tax invoice and credit note you send out.

- Any official letters or emails to the FTA.

- Your VAT returns and other tax filings.

Forgetting to put your TRN on an invoice makes it invalid, meaning your customer can't reclaim the VAT they paid you. It's just as important to check the TRNs of your suppliers to make sure their invoices are valid. For more on this, have a look at our guide on how to perform an FTA TRN verification. A quick check can save you a world of trouble.

Managing Your VAT Returns, Payments, and Records

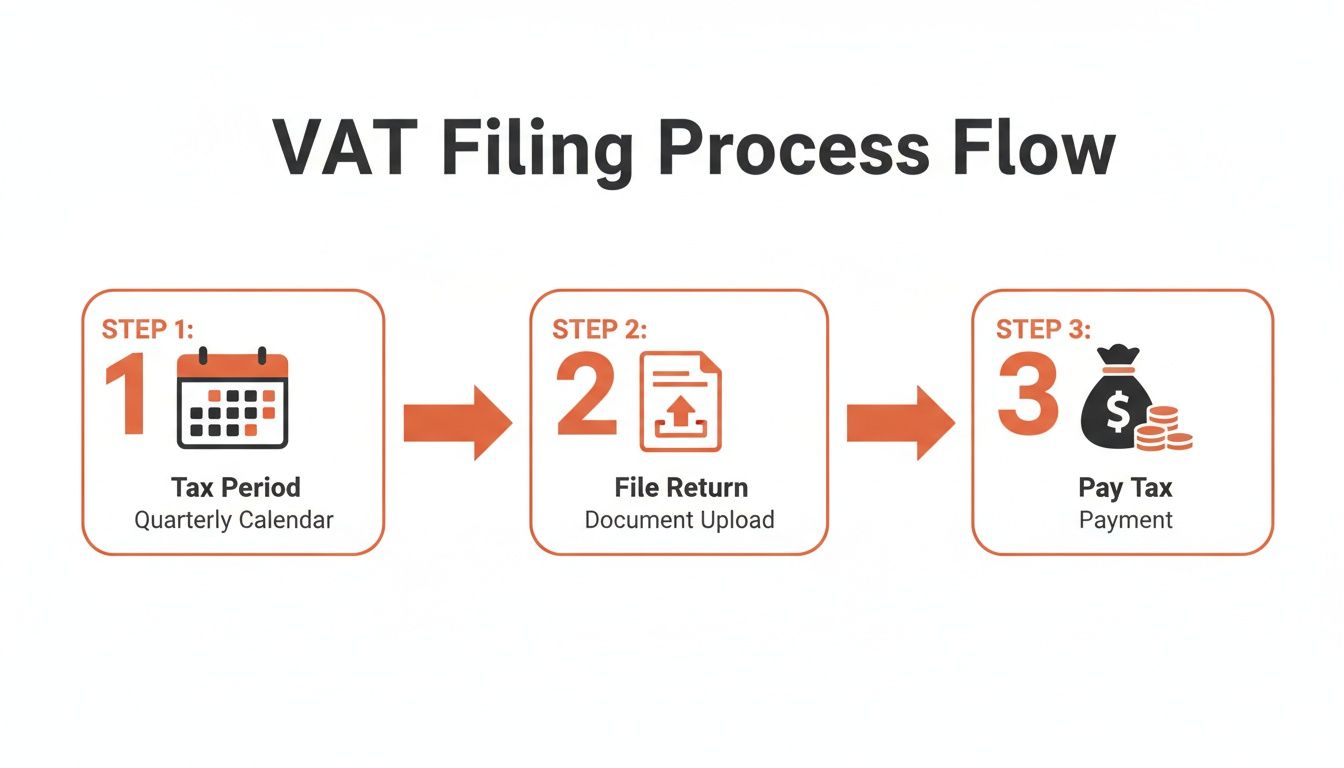

Getting a handle on your VAT obligations in the UAE is all about rhythm. It’s a constant cycle of filing returns and making payments to the Federal Tax Authority (FTA). Understanding this rhythm transforms VAT from an abstract concept into a manageable, routine part of your financial operations.

The entire system is built around what the FTA calls tax periods. For most businesses, that means filing a VAT return every quarter. However, always double-check your assigned period on the FTA's e-Services portal, as some larger businesses may be on a monthly cycle.

Filing and Payment Deadlines

The moment a tax period closes, a new clock starts ticking. You have until the 28th day of the following month to get your VAT return submitted and the payment settled with the FTA. This isn't a guideline—it's a hard deadline.

For example, if your tax quarter ends on March 31, your return and payment must be in by April 28. Missing this date triggers automatic penalties for both late filing and late payment.

What Goes into a VAT Return?

Your VAT return is a snapshot of your business activity for that period. It’s where you report all the key figures to determine your net VAT position.

Here’s a breakdown of what you need to declare:

- Total Sales and All Other Outputs: The total value of everything you sold, broken down by Emirate.

- Total Purchases and All Other Inputs: The total value of goods and services you bought for the business.

- Output VAT: All the VAT you charged and collected from your customers.

- Recoverable Input VAT: The VAT you paid on your business purchases that you’re allowed to claim back.

The calculation is simple: subtract your Recoverable Input VAT from your Output VAT. If the result is positive, that’s what you owe the FTA. If it’s negative, you’re in a refund position.

The Five-Year Rule for Record Keeping

This is non-negotiable. The FTA requires every business to keep detailed financial records for a minimum of five years. This isn't just good practice; it's the law. In the event of an audit, these records are your proof of compliance.

Your records must be good enough for the FTA to easily trace and verify every transaction. We're talking about tax invoices, credit notes, import/export documents, and any ledgers tied to your sales and purchases. Solid record-keeping is your first line of defense and ensures you claim back every dirham of input tax you're entitled to.

Preparing for the UAE E-Invoicing Mandate

The way you manage VAT UAE compliance is on the verge of a major overhaul. The future is digital, and the mandatory switch to UAE e-invoicing is coming up fast. We’re moving away from sending simple PDFs to a system built on structured, machine-readable data.

For any finance manager or accountant, understanding this shift is non-negotiable. It’s about connecting today’s invoicing rules with the fast-approaching mandate to ensure your business remains compliant not just for today, but for what’s next.

Current Tax Invoice Requirements

Before we jump into the future, let’s quickly recap the fundamentals of a compliant tax invoice under current FTA rules. A proper tax invoice is a legal document that needs to tick every box to be valid for VAT.

Right now, every standard tax invoice you issue must clearly include:

- The words "Tax Invoice" displayed prominently.

- Your business name, address, and Tax Registration Number (TRN).

- The customer's name, address, and TRN (if they’re also VAT-registered).

- A unique invoice number and the date it was issued.

- A clear description of the goods or services provided.

- The total amount due in AED, with a clear breakdown of the net amount, the 5% VAT rate, and the final VAT amount.

This information feeds directly into the current VAT filing process.

The Shift to E-Invoicing and PINT AE

The upcoming mandate completely transforms this workflow. An e-invoice isn't just a PDF you email. It’s a structured digital file that must follow a very strict format known as PINT AE, the UAE’s specific version of the global Peppol framework.

This means your invoicing data has to be perfectly structured so government systems can read and process it automatically. The end goal is a tax system that’s seamless, transparent, and far more efficient.

The rollout is planned in phases, starting in July 2026. This timeline gives businesses a window to get ready, but it’s a period for proactive planning, not waiting. For a deep dive into the specific deadlines, you can find all the details in our complete guide to UAE e-invoicing.

The Importance of Pre-Submission Validation

The new system will have zero tolerance for mistakes. An e-invoice with an incorrectly formatted TRN, a missing field, or a tiny calculation error will be rejected on the spot. This makes pre-submission validation a critical new step in your accounting workflow.

Before your e-invoice data even leaves your system, you must be confident it is 100% compliant with all the PINT AE business rules. Waiting for an official rejection creates delays, heaps of manual rework, and puts you at risk of non-compliance.

This is exactly why tools that can validate your invoice data before you submit it are becoming essential. By running your invoice exports through a pre-processor like Tadqiq, you can catch and fix every single error beforehand. This ensures a first-time-pass rate, keeps your operations running smoothly, and gives you total peace of mind in your FTA compliance.

How to Avoid Common VAT Mistakes and FTA Penalties

Navigating the UAE’s VAT system is all about attention to detail. Even small, unintentional mistakes can attract hefty penalties from the Federal Tax Authority (FTA), turning a minor oversight into a major headache. For any finance manager, getting to grips with these common tripwires is the first step toward a robust compliance strategy.

The FTA’s penalties exist to enforce total accuracy and timeliness. The key is to get ahead of the risks by knowing where they hide.

Incorrect Calculations and Data Entry Errors

You’d be surprised how often compliance issues come down to simple human error. A miscalculation on an invoice, applying the wrong rate, or a typo during data entry—these are the everyday mistakes that lead to incorrect VAT returns and can trigger an FTA audit.

These slip-ups are especially common in businesses that still lean heavily on manual processes. One misplaced decimal point is all it takes to throw off your entire return. With the upcoming mandate for UAE e-invoicing, the stakes for data accuracy will be even higher, as the PINT AE system will automatically reject invoices with calculation errors.

Late Registration and Filing

If there’s one thing the FTA is serious about, it’s deadlines. The authority enforces strict timelines for both registering for VAT and filing your periodic returns. Missing these dates triggers immediate penalties that can quickly add up.

The rules are black and white. Failing to register for VAT within 30 days of crossing the mandatory AED 375,000 threshold will land you an initial AED 10,000 fine. Late VAT returns or payments bring on monthly penalties, while an incorrect return itself can attract a fixed fine. You can learn more about the full scope of these penalties and how to avoid them.

To stay out of trouble, you need a rock-solid system for tracking key dates:

- Monitor Your Turnover: Keep a rolling 12-month check on your taxable supplies.

- Set Calendar Alerts: Give your finance team plenty of warning before the 28-day filing deadline.

- Plan Your Payments: Ensure funds are ready to go before the due date.

Poor Record Keeping

Under UAE law, every business must keep detailed financial records for at least five years. This isn't just a suggestion—it's a legal requirement. These records include all your tax invoices, credit notes, and accounting books. If you can't produce these on demand during an audit, you're facing another set of significant penalties.

Think of your records as your primary evidence of FTA compliance. They’re what you’ll use to justify the figures in your VAT returns and prove that every Dirham of input tax you reclaimed was legitimate. Without a clean, organized audit trail, you leave your business wide open to challenges.

Your Path to Seamless VAT and E-Invoicing Compliance

Getting to grips with VAT UAE isn't just about ticking a legal box; it's a core part of running a financially sound business. We’ve walked through the key details – the 5% standard rate, when you need to register, your filing obligations, and the major shift towards digital invoicing.

With the upcoming UAE e-invoicing mandate and its strict PINT AE standards, getting your data right the first time is more critical than ever. Automating your validation process is the most practical way to ensure FTA compliance. By ensuring your data is perfect before submission, you save your team from the headache of rejected files, costly delays, and tedious manual fixes.

Ready to streamline your e-invoicing? Try Tadqiq today.